Navigating Gifts in Tally: A Comprehensive Guide to Accounting for Gratuities

Related Articles: Navigating Gifts in Tally: A Comprehensive Guide to Accounting for Gratuities

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Gifts in Tally: A Comprehensive Guide to Accounting for Gratuities. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Gifts in Tally: A Comprehensive Guide to Accounting for Gratuities

In the realm of accounting, maintaining meticulous records is paramount. This principle extends to the handling of gifts, which, while seemingly simple, can pose complexities when it comes to accounting software like Tally. Understanding the appropriate accounting treatment for gifts is crucial for ensuring accurate financial statements and complying with tax regulations.

The Importance of Accurately Recording Gifts

Gifts, whether received or given, hold significant implications for financial reporting. Failing to properly account for them can lead to:

- Inaccurate Financial Statements: Misclassifying or omitting gift transactions can distort the true financial position of a business, leading to misleading financial statements.

- Tax Compliance Issues: Gifts may be subject to specific tax regulations, and failing to record them accurately can result in penalties or fines.

- Lack of Transparency: Proper accounting for gifts ensures transparency and accountability, fostering trust among stakeholders.

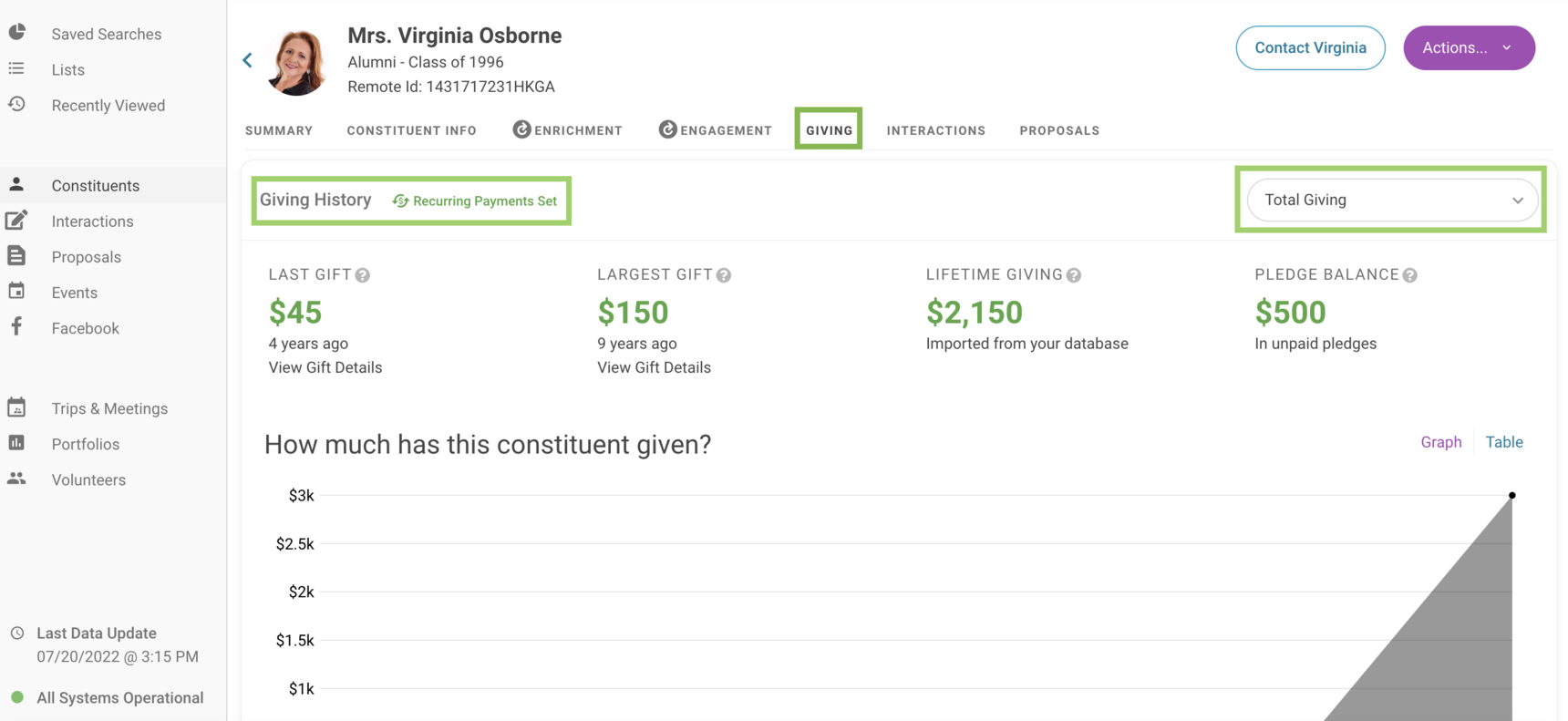

Understanding Gift Accounting in Tally

Tally, a popular accounting software, offers flexibility in handling gifts. The key is to categorize them appropriately based on the nature of the gift and its relevance to the business. Here’s a breakdown of the common accounting heads for gifts in Tally:

1. Gift Received:

- Direct Income: If the gift received is directly related to the business’s revenue-generating activities, it should be recorded as "Direct Income." This could include gifts from customers as a form of appreciation or incentives for purchases.

- Other Income: Gifts that are not directly related to the business’s core operations but still provide a benefit, such as a donation from a charitable organization, are classified as "Other Income."

- Liabilities: Gifts received that require repayment, such as a loan or advance, should be recorded as a "Liability" until the obligation is fulfilled.

2. Gift Given:

- Expenses: Gifts given to employees, clients, or business partners as a form of appreciation or goodwill are typically recorded as "Expenses." This could include gifts for holidays, special occasions, or promotional purposes.

- Assets: Gifts given that are intended to be used in the business’s operations, such as equipment or supplies, should be recorded as "Assets."

- Liabilities: Gifts given that represent a prepayment or advance should be recorded as a "Liability" until the obligation is fulfilled.

Key Considerations for Gift Accounting

- Nature of the Gift: The primary consideration is the nature of the gift. Is it directly related to the business’s revenue generation, or is it a general benefit or goodwill gesture?

- Gift Value: The value of the gift is crucial for determining the appropriate accounting treatment. Minor gifts may be treated differently from significant ones.

- Tax Implications: Understanding the tax implications of gifts is essential for compliance. Some gifts may be subject to specific tax regulations, such as gift tax or income tax.

FAQs on Gift Accounting in Tally

Q: What if the gift is a tangible asset, like a laptop?

A: A tangible asset received as a gift should be recorded as an "Asset" under the relevant category, such as "Computer Equipment." The cost of the asset should be reflected in the accounting records.

Q: How do I account for gifts given to employees?

A: Gifts given to employees are typically recorded as "Expenses" under the category "Employee Benefits." The value of the gift should be documented and included in the expense calculation.

Q: What about gifts received from customers?

A: Gifts received from customers, especially those related to sales promotions or incentives, should be recorded as "Direct Income." The revenue generated from the customer’s purchase should be considered alongside the gift received.

Tips for Effective Gift Accounting in Tally

- Establish Clear Policies: Develop clear internal policies regarding the acceptance and giving of gifts to ensure consistency and transparency.

- Maintain Detailed Records: Maintain detailed records of all gift transactions, including the date, description, value, and recipient.

- Utilize Tally’s Features: Leverage Tally’s functionalities, such as the "Gift Received" and "Gift Given" entries, to streamline the accounting process.

- Seek Professional Advice: Consult with a tax professional or accountant for guidance on specific gift accounting requirements and tax implications.

Conclusion

Accurately accounting for gifts is an essential aspect of maintaining sound financial records. By understanding the different accounting heads for gifts in Tally and following the guidelines outlined above, businesses can ensure accurate financial reporting, compliance with tax regulations, and transparency in their financial dealings.

Closure

Thus, we hope this article has provided valuable insights into Navigating Gifts in Tally: A Comprehensive Guide to Accounting for Gratuities. We thank you for taking the time to read this article. See you in our next article!